Some reasons behind low bitcoin transaction fees

Segwit, lightning and user growth composition as structural changes for fees.

I’m sure you all have heard/read about bitcoin transaction fees being low. Well, they are not only low, they are at levels comparable to 2014 in terms of bitcoin on a total daily basis. This is clear in the chart below.

Historically, high fees have been associated with high network activity and bull markets (see high fees at the end of the last bull run in 2018), so naturally some may argue that the current fee situation could signal this bull run has peaked.

However, I argue that the a low-fee environment is a result of a shift in user behavior and network changes, and hence, the high-fee-bull-run relation may not be so straight forward any more.

Specifically, we will analysize three factors that could explain the low-fee environment:

User/address’ holdings growth behavior.

SegWit.

Lighning Network.

Let’s take a look at these three separately and see how they relate to a lower-fee environment.

1. User/address holdings growth behavior

Retail growth has slowed down significantly after the 2017 market top.

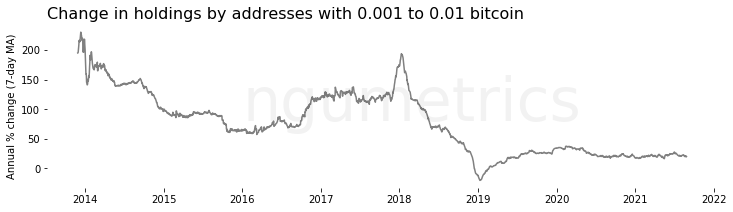

After the 2017-2018 market top, the growth in bitcoin holdings by small addresses has slowed down significantly. For example, between 2016 and 2017, bitcoin holdings in addresses with 0.001 to 0.01 bitcoin grew at an annual rate of 50%-200%. Since 2019, the growth rate has been below 50%. See the chart below.

The same growth pattern is present for groups of addresses holding up to 10 bitcoin. This implies less on-chain network use of from retail investors/users.

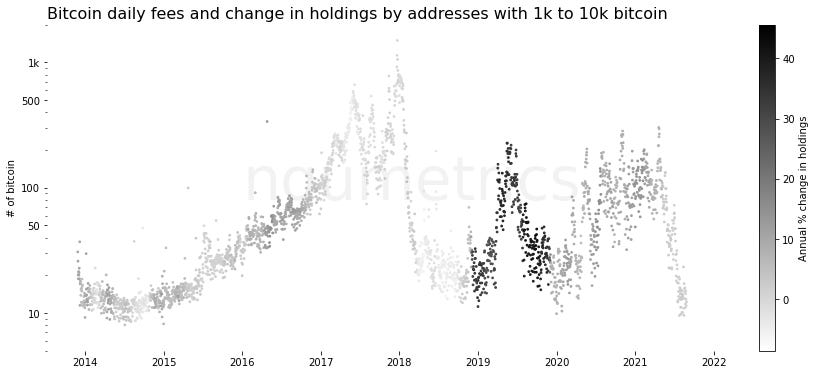

We can visualize this with the chart below, which shows daily fees in number of bitcoin and the growth in holdings of addresses with 0.001 to 0.01 bitcoin mapped to it as the color. The darker the color, the higher the growth in holdings.

The chart shows that as retail investors/users’ holdings grew faster, fees were increasing (see the darker color at the top around 2018). Since 2019, fees have been lower at the same time that growth in holdings has diminished (more clear color in the chart). The same is true for groups of addresses holding up to 10 bitcoin.

You may wonder what caused the spike in fees in 2019 and 2021. In terms of users/addresses, this was more related to institutional investor activity as they began to accumulate bitcoin at the bottom of 2019 and again in 1Q 2021 (pandemic selloff).

This can be see in the chart above, fees increasing at the same time that growth in holdings of institutional investors accelerated. The 1Q 2021 increase was a result of the same but for addresses holding 10k-100k bitcoin.

2. SegWit

Segwit was a bitcoin protocol upgrade intended to provide protection from transaction malleability and increase block capacity1. The “increase” in block capacity allowed for blocks larger than 1 MB without a hardfork change.

In practice, SegWit increased bitcoin’s network transaction capacity, which in theory would tend to take away upward pressure from fees.

In reality, this is what’s happened. Take a look at the chart below that shows SegWit transactions as % of total block transactions and the median fee per transaction (color).

We can point out some interesting things:

SegWit transactions as % of total transactions per block are in a clear upward trend (orange line), more people/institutions have adopted this upgrade that increases the network’s throughput.

The % of SegWit transactions per block is hovering all-time-highs at around 73%.

Blocks with higher % of SegWit transactions tend to have lower fees and vice-versa. For example, see blocks between 500k-600k. Blocks with SegWit transactions below 20% have higher fees (see pockets of darker dots).

The last parabolic raise in SegWit transactions in each block matches the decline in transaction fees experienced recently.

3. Lightning

The Lightning Network (LN, Lightning) is a second layer network built on top of bitcoin that allows for cheaper and faster transactions, at larger transaction capacity.

One of the key features of LN is to reduce blockchain load by allowing users to make frequent payments secured by bitcoin without placing excessive load on full nodes which must process every transaction on the blockchain.2

Basically all transactions happening on the LN would have to be done on the bitcoin network if Lightning didn’t exist (or maybe would have never been made). As more and more operations are done via the LN it takes pressure off from the bitcoin network’s block space and from transaction fees.

So how is the LN doing in term of transactions? I understand that it is not possible to know exactly how much transactions occur on lightning, however, we can take a look at some data and anecdotal evidence to gasp activity on it.

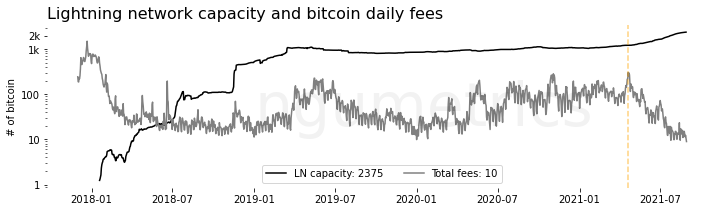

1. The value available to transact in the LN has grown significantly in 2021 (curently up 128% y/y, the fastest annual pace since early 2020), coinciding with fee decline on the bitcoin network (see chart below after the dashed vertical orange line).

More value available to transact on lightning is a proxy of more transactions happening on it.

2. Anecdotal evidence sugests lightning wallets are processing “hundreds of thousands” transactions a month.

See below a twitt from Breez lightning wallet talking about how many transactions they process.

Breez is only one lightning wallet, there are several more, so we are probably talking about millions of transactions per month. For comparison, the bitcoin network has processed about 7.7 million transactions in the last month.

In terms of transaction numbers Lightning is already significant and is taking away fee preassure from the bitcoin network.

https://en.bitcoin.it/wiki/Segregated_Witness

https://en.bitcoin.it/wiki/Lightning_Network

Totally not because of Chinese miners spamming low fee txs to fill up blocks and force fee rates up 🙄